In a world buzzing with entrepreneurial spirit, the pursuit of financial success has become a common aspiration. Whether you’re aiming for a side income or dreaming of a lucrative venture, there are myriad ways to fast-track your wealth. Here are nine ingenious money-making ideas that can help you pave your way to financial abundance:

“Cash Flow Explosion: Start Earning Big Bucks TODAY – Absolutely FREE Training!”

1. E-commerce Entrepreneurship:

The digital realm offers boundless opportunities for enterprising individuals. Creating an online store or leveraging established platforms like Amazon or Etsy to sell niche products can be a lucrative venture. Identify a demand, source unique or in-demand items, and utilize effective marketing strategies to carve your niche in the e-commerce landscape.

2. Investing in Stocks and Cryptocurrency:

While investing inherently involves risk, it also presents a pathway to substantial returns. Diving into the stock market with a diversified portfolio or exploring the volatile yet potentially rewarding world of cryptocurrency can be financially rewarding. However, prudent research, staying informed, and understanding market trends are crucial for success in these domains.

“Cash Flow Explosion: Start Earning Big Bucks TODAY – Absolutely FREE Training!”

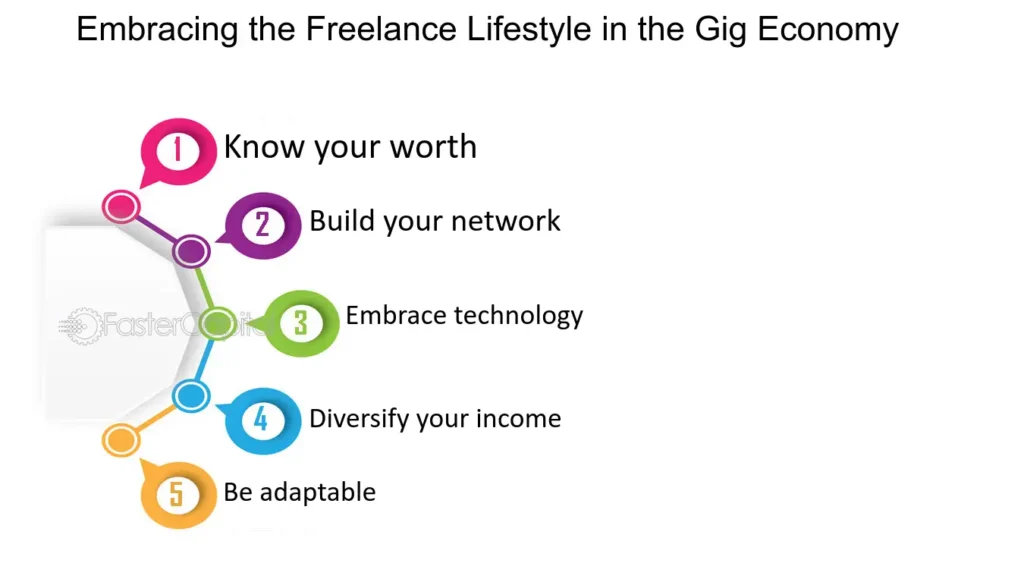

3. Freelancing and Gig Economy:

The gig economy is flourishing, offering freelancers an array of opportunities across various industries. Skills like graphic design, copywriting, programming, and digital marketing are in high demand. Platforms such as Upwork, Fiverr, and Freelancer.com serve as hubs to showcase your skills and connect with potential clients worldwide.

4. Real Estate Ventures:

Real estate has long been a cornerstone of wealth creation. Whether it’s flipping properties for profit, investing in rental properties for passive income, or participating in real estate crowdfunding, this sector provides multifaceted avenues to grow your wealth

“Cash Flow Explosion: Start Earning Big Bucks TODAY – Absolutely FREE Training!”

5. Creating and Monetizing Content:

Content creation, through blogging, podcasting, video production, or social media, has emerged as a viable revenue stream. Engaging content that caters to a specific audience can attract sponsorships, advertisements, affiliate marketing, and even dedicated fan support through platforms like Patreon.

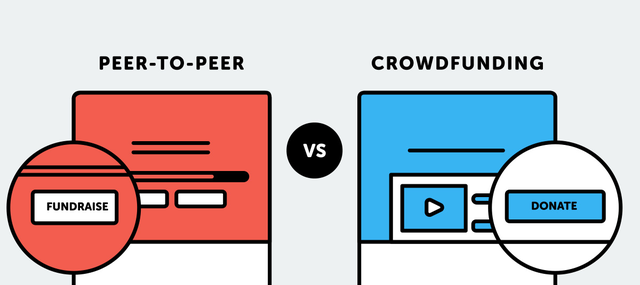

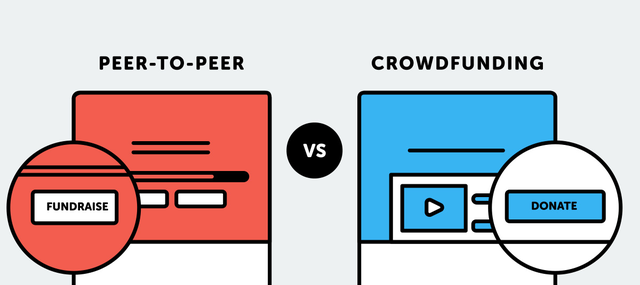

6. Peer-to-Peer Lending and Crowdfunding:

Participating in peer-to-peer lending platforms or crowdfunding initiatives can diversify your investment portfolio. By lending money directly to individuals or contributing to projects with potential, you can earn returns that often surpass traditional savings accounts.

“Cash Flow Explosion: Start Earning Big Bucks TODAY – Absolutely FREE Training!”

7. Developing Mobile Apps or Software:

With the digital age in full swing, the demand for innovative mobile apps and software solutions continues to rise. If you possess coding skills or have a great idea, developing and launching your own app or software can yield substantial financial rewards.

8. Consulting and Coaching Services:

Your expertise and experience in a particular field can be monetized through consultancy or coaching services. Providing guidance, advice, or training to businesses or individuals seeking your knowledge can be a profitable venture.

9. Utilizing the Sharing Economy:

Leveraging assets you own, such as a spare room through platforms like Airbnb, a vehicle via Uber or Lyft, or even renting out equipment or tools, presents opportunities to earn extra income through the sharing economy.

“Cash Flow Explosion: Start Earning Big Bucks TODAY – Absolutely FREE Training!”

In conclusion, the avenues for making money are diverse and ever-expanding, catering to varied interests and skill sets. However, success in any venture demands dedication, continuous learning, and adaptability to market changes. Choosing the right path aligned with your skills, interests, and market demands, combined with perseverance and a strategic approach, can pave the way to accelerating your wealth creation journey.

E-commerce Entrepreneurship

E-commerce entrepreneurship involves building, managing, and growing a business that primarily operates online, selling products or services through the internet. It revolves around leveraging digital platforms to conduct commercial transactions, reach customers, and facilitate the buying and selling process.

“Cash Flow Explosion: Start Earning Big Bucks TODAY – Absolutely FREE Training!”

Key elements of e-commerce entrepreneurship include:

- Online Store Creation: Entrepreneurs establish their online presence through websites or platforms like Shopify, WooCommerce, or Amazon, where they showcase their products or services.

- Product Sourcing or Creation: Entrepreneurs source products from suppliers, manufacture their own goods, or create digital products to sell. This may involve finding reliable suppliers, negotiating deals, or developing unique offerings.

- Digital Marketing: Utilizing various digital marketing strategies like SEO, social media marketing, content marketing, and paid advertising to attract potential customers to their online store. This involves understanding customer behavior, market trends, and optimizing strategies to increase visibility and sales.

- Customer Experience and Service: Providing excellent customer service is crucial in e-commerce. This includes ensuring a smooth buying experience, addressing customer queries or concerns promptly, and maintaining high-quality products and services.

- Logistics and Fulfillment: Managing the logistics of product storage, packaging, and shipping efficiently. This may involve partnerships with shipping companies or utilizing fulfillment centers to streamline operations.

- Data Analysis and Optimization: Analyzing customer data, sales metrics, and market trends to make informed decisions. Optimizing product offerings, pricing strategies, and marketing efforts based on this analysis helps in maximizing profitability.

E-commerce entrepreneurship offers several advantages, including low entry barriers compared to traditional brick-and-mortar businesses, a global reach, flexible work arrangements, and scalability. However, it also requires adaptability to technological advancements, staying updated with market trends, and addressing the challenges posed by competition, cybersecurity, and evolving consumer preferences.

Successful e-commerce entrepreneurs often possess a combination of business acumen, digital marketing skills, a keen understanding of their target audience, and the ability to innovate in a constantly evolving online landscape.

Investing in Stocks and Cryptocurrency

Investing in stocks and cryptocurrency can be attractive for several reasons, though they come with different risk profiles and opportunities:

“Cash Flow Explosion: Start Earning Big Bucks TODAY – Absolutely FREE Training!”

Investing in Stocks:

- Historical Returns: Historically, stocks have provided substantial returns over the long term, outpacing inflation and offering potential for wealth creation.

- Diversification: Stocks offer a wide range of investment options across industries and sectors, allowing investors to diversify their portfolios and spread risk.

- Dividends and Ownership: Some stocks pay dividends, providing regular income to investors. Owning stocks also means owning a portion of the company, granting certain voting rights and a stake in its profits.

- Liquidity: Stocks are relatively liquid assets, meaning they can be easily bought or sold on the stock market, providing flexibility to investors.

Investing in Cryptocurrency:

- High Volatility and Potential Returns: Cryptocurrencies, like Bitcoin and Ethereum, have shown high volatility, which can lead to substantial returns within a short period. Early investors in some cryptocurrencies have experienced significant gains.

- Decentralization and Innovation: Cryptocurrencies operate on decentralized blockchain technology, offering potential for innovation in various sectors beyond finance.

- Diversification of Portfolio: Including a small portion of cryptocurrencies in an investment portfolio can provide diversification beyond traditional assets like stocks and bonds.

- Emerging Asset Class: As the crypto market matures, some investors see it as an emerging asset class with growth potential, though it comes with higher risk due to regulatory uncertainty and market fluctuations.

However, both stocks and cryptocurrencies carry risks:

Risks of Stocks:

- Market Volatility: Stock prices can be volatile, impacted by market trends, economic conditions, and company-specific factors.

- Company-Specific Risks: Individual stocks can be affected by company performance, management changes, or industry disruptions.

Risks of Cryptocurrency:

- Volatility: Cryptocurrencies are known for their extreme price fluctuations, which can lead to significant gains or losses within a short period.

- Regulatory and Security Risks: Regulatory changes and cybersecurity threats can impact the value and legality of cryptocurrencies.

Investing in stocks and cryptocurrencies requires careful research, understanding risk tolerance, and a long-term investment perspective. It’s advisable for investors to diversify their portfolios, conduct thorough due diligence, and consider seeking advice from financial professionals before making investment decisions in these volatile markets.

Freelancing and Gig Economy

Freelancing and the gig economy represent a significant shift in the way people work and earn a living. Here’s an overview of these concepts:

“Cash Flow Explosion: Start Earning Big Bucks TODAY – Absolutely FREE Training!”

Freelancing:

Freelancing involves working as an independent contractor, offering services or expertise to clients or businesses on a project basis. Freelancers are self-employed individuals who typically work remotely and are not bound to a long-term contract with any single employer. They provide services ranging from graphic design, writing, programming, marketing, consulting, and more.

Key aspects of freelancing include:

- Flexibility: Freelancers have the freedom to choose their clients, projects, and work hours. This flexibility allows them to balance work with personal commitments.

- Diverse Clientele: Freelancers often work with a diverse range of clients, which can provide exposure to different industries and projects.

- Remote Work: Many freelancers work remotely, utilizing digital tools and communication platforms to collaborate with clients from anywhere in the world.

- Variable Income: Freelancers may experience fluctuations in income based on project availability and client demands. Managing finances and maintaining a steady flow of projects are essential aspects of freelancing.

Gig Economy:

The gig economy encompasses a broader landscape where temporary, flexible jobs—referred to as “gigs”—are prevalent. These gigs can range from freelance work to short-term contracts, part-time roles, and on-demand jobs facilitated by various online platforms.

Key features of the gig economy include:

- Platform-Based Work: Many gig workers find opportunities through digital platforms like Uber, Lyft, Upwork, TaskRabbit, and Fiverr. These platforms connect freelancers or independent contractors directly with clients or customers seeking specific services.

- Diverse Opportunities: The gig economy spans multiple sectors, including transportation, delivery, hospitality, creative services, and more. It offers a wide array of job options catering to different skill sets.

- Supplemental Income: For some, gig work serves as a primary source of income, while for others, it supplements their main job or provides additional income streams.

- Controversies and Challenges: The gig economy has faced criticism regarding worker rights, benefits, and job security. Discussions around fair wages, labor rights, and access to benefits like healthcare and retirement plans for gig workers remain ongoing.

Both freelancing and the gig economy have reshaped the traditional employment landscape by providing individuals with more autonomy, flexibility, and diverse income opportunities. However, they also come with challenges related to income stability, benefits, and navigating the complexities of self-employment.

Real Estate Ventures

Real estate ventures refer to a range of activities and investments within the real estate industry aimed at generating profits. This sector encompasses various strategies and opportunities for individuals or entities to leverage properties for financial gain. Here are some key aspects of real estate ventures:

- Property Flipping: This involves buying properties, often distressed or undervalued, refurbishing or renovating them, and selling them at a higher price. The goal is to generate profit through the appreciation of the property’s value after improvements.

- Rental Properties: Investing in rental properties involves purchasing real estate with the intention of leasing it out to tenants. The rental income provides a steady cash flow, and the property may appreciate in value over time. It can involve residential, commercial, or vacation properties.

- Real Estate Development: This involves purchasing land, obtaining necessary permits, and overseeing the construction or renovation of properties. Real estate developers build residential, commercial, or mixed-use properties and then sell or lease them for profit.

- Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-producing real estate across various property sectors. Investors can buy shares in REITs, which offer the potential for regular dividends and capital appreciation without directly owning physical properties.

- Real Estate Crowdfunding: This involves multiple investors pooling their resources to invest in real estate projects or properties. Online platforms facilitate crowdfunding, allowing individuals to invest in properties with smaller amounts of capital.

- Real Estate Wholesaling: Wholesalers act as intermediaries who find off-market properties at discounted prices and then sell these contracts to investors or buyers for a fee without owning the property themselves.

Real estate ventures offer several advantages:

- Potential for Appreciation: Real estate values often appreciate over time, providing the potential for long-term wealth accumulation.

- Passive Income: Rental properties can generate regular passive income through rental payments.

- Diversification: Real estate investments offer diversification within an investment portfolio, potentially reducing overall risk.

- Tax Benefits: Investors can benefit from tax advantages such as depreciation deductions, mortgage interest deductions, and 1031 exchanges (in the U.S.).

However, real estate ventures also come with risks:

- Market Volatility: Real estate markets can experience fluctuations in property values due to economic factors.

- High Capital Requirement: Initial investment capital required for purchasing properties can be substantial.

- Management and Maintenance: Managing properties involves responsibilities, expenses, and potential issues with tenants or maintenance.

Successful real estate ventures often require thorough research, market analysis, understanding of local regulations, and a strategic approach to maximize returns while managing risks effectively.

Creating and Monetizing Content

Creating and monetizing content involves producing valuable and engaging material across various mediums such as written articles, videos, podcasts, photography, artwork, and more, and then leveraging that content to generate income. Here’s an overview of the process:

“Cash Flow Explosion: Start Earning Big Bucks TODAY – Absolutely FREE Training!”

Content Creation:

- Identifying a Niche or Topic: Content creators often focus on specific niches or subjects that align with their expertise, interests, or audience preferences.

- Producing High-Quality Content: This includes writing informative articles, creating engaging videos, recording podcasts, designing graphics, or any other form of content that resonates with the target audience.

- Consistency and Engagement: Regularly publishing quality content helps build a dedicated audience. Engagement with the audience through comments, discussions, and social media interactions is crucial for growth.

- Understanding SEO and Trends: Optimizing content for search engines (SEO) helps in reaching a wider audience. Staying updated with trends and creating content around popular topics can attract more viewers/readers.

Monetization Strategies:

- Advertising and Sponsorships: Content creators can earn revenue by displaying ads on their platforms (websites, YouTube videos, podcasts) or partnering with brands for sponsorships or endorsements.

- Affiliate Marketing: Promoting products or services through unique affiliate links within the content. When audiences make purchases through these links, creators earn a commission.

- Subscription or Membership Models: Offering exclusive content, courses, or community access in exchange for a subscription fee or membership dues.

- Selling Digital Products: Creating and selling digital products like e-books, online courses, templates, or artwork directly to the audience.

- Crowdfunding or Donations: Platforms like Patreon allow fans to support content creators through monthly pledges or one-time donations.

- Licensing and Syndication: Licensing content for use by other platforms, publications, or companies in exchange for royalties or fees.

Successful monetization of content often requires a combination of strategies tailored to the content type, audience, and creator’s goals. Content creators must also maintain authenticity, quality, and engagement with their audience while balancing monetization efforts.

However, achieving significant income from content creation typically takes time and consistent effort. It requires building a loyal audience base and continuously adapting to changes in audience preferences, platform algorithms, and industry trends.

Peer-to-Peer Lending and Crowdfunding

Peer-to-peer lending involves individuals lending money to other individuals or businesses through online platforms, bypassing traditional financial institutions like banks. This lending model connects borrowers directly with lenders, often at more favorable rates compared to traditional banking options.

Key aspects of P2P lending include:

- Platform Facilitation: Online platforms, such as Prosper, LendingClub, or Funding Circle, act as intermediaries, facilitating the lending process. They match borrowers seeking loans with individual investors or lenders willing to fund those loans.

- Diverse Borrower Profiles: P2P lending platforms cater to various borrower profiles, including individuals seeking personal loans, small businesses requiring funding, or borrowers with specific credit needs.

- Risk and Return: Investors/lenders on P2P platforms assess the risk associated with potential borrowers based on their creditworthiness, financial history, and other factors. Higher-risk borrowers may offer higher potential returns but come with increased risk of default.

- Interest Income: Investors/lenders earn returns through interest payments made by borrowers over the loan term. The platform typically manages loan servicing, collecting payments, and distributing returns to investors.

Crowdfunding:

Crowdfunding involves raising funds from a large number of individuals, typically through online platforms, to finance a project, business venture, or personal cause.

There are various types of crowdfunding:

- Reward-Based Crowdfunding: Contributors pledge funds to support a project or idea in exchange for non-monetary rewards or early access to products/services. Platforms like Kickstarter and Indiegogo operate on this model.

- Equity-Based Crowdfunding: Investors receive equity or ownership stakes in a company in return for their financial contributions. This model allows individuals to invest in startups or small businesses. Equity crowdfunding platforms like SeedInvest and Crowdcube operate in this space.

- Donation-Based Crowdfunding: Individuals or organizations seek donations for charitable causes, medical expenses, creative projects, or community initiatives without offering tangible rewards or financial returns. Platforms like GoFundMe and JustGiving operate on donation-based models.

- Debt-Based Crowdfunding: Similar to P2P lending, debt-based crowdfunding platforms enable individuals or businesses to raise funds by borrowing from multiple investors/lenders who expect repayment with interest over time.

Crowdfunding platforms provide visibility and access to a large pool of potential backers or investors, allowing creators, entrepreneurs, or individuals to showcase their projects or causes and secure funding from supporters across the globe. The success of a crowdfunding campaign often depends on effective marketing, a compelling pitch, and engaging with the community to gain support for the project or cause.

Developing Mobile Apps or Software

Developing mobile apps or software involves the creation, design, and programming of applications or computer programs intended to run on mobile devices, computers, or other digital platforms. Here’s an overview:

Mobile App Development:

- Idea Generation: Developers conceptualize an app idea, identifying its purpose, target audience, and functionality. This stage involves market research and understanding user needs.

- Design Phase: User interface (UI) and user experience (UX) designers create wireframes and prototypes, focusing on the app’s visual appeal, usability, and navigation.

- Development: Programmers and developers write the code for the app, using programming languages like Java, Swift, Kotlin, or React Native, depending on the platform (iOS, Android, cross-platform).

- Testing: Rigorous testing is conducted to identify and fix bugs, ensure functionality across different devices, and optimize performance and security.

- Launch and Maintenance: The app is launched on app stores (e.g., Apple App Store, Google Play Store), and post-launch maintenance involves updates, bug fixes, and feature enhancements.

Software Development:

- Requirement Analysis: Software developers gather and analyze requirements from stakeholders to understand the software’s purpose, functionalities, and desired outcomes.

- Design and Architecture: Designers and architects create a blueprint or architecture for the software, defining its structure, components, and how they interact.

- Coding and Implementation: Programmers write the code using programming languages like Python, Java, C++, etc., to build the software according to the design specifications.

- Testing and Quality Assurance: Rigorous testing is conducted to ensure the software functions as intended, meeting quality standards, and is free from errors or vulnerabilities.

- Deployment and Maintenance: The software is deployed for use by intended users. Post-deployment maintenance involves updates, patches, and support to ensure its smooth operation.

Both mobile app and software development require a range of technical skills, including programming languages, knowledge of development frameworks and tools, understanding of UI/UX principles, and familiarity with security protocols. Collaboration among designers, developers, testers, and project managers is crucial throughout the development lifecycle.

Consulting and Coaching Services

Consulting and coaching services involve offering expertise, guidance, and support to individuals, businesses, or organizations to help them achieve specific goals, solve problems, or improve performance in various areas. While both involve providing advice and assistance, there are distinctions between consulting and coaching:

“Cash Flow Explosion: Start Earning Big Bucks TODAY – Absolutely FREE Training!”

Consulting Services:

- Expertise and Solutions: Consultants are hired for their specialized knowledge and experience in a particular industry, field, or skill set. They analyze problems, provide recommendations, and often implement solutions for clients.

- Project-Based Approach: Consultants typically work on specific projects or assignments, offering solutions, strategies, or plans to address client needs. They might conduct research, perform assessments, and deliver tangible outcomes or deliverables.

- External Perspective: Consultants provide an external perspective, bringing fresh insights, best practices, and industry benchmarks to help organizations improve efficiency, solve challenges, or capitalize on opportunities.

- Business Improvement: Consulting services often focus on improving business processes, strategy, operations, management practices, or specific areas such as marketing, finance, technology, or human resources.

Coaching Services:

- Personal and Professional Development: Coaches work with individuals or groups to help them identify and achieve personal or professional goals. They facilitate self-discovery, skill development, and behavioral changes.

- Goal-Oriented Approach: Coaches support clients in defining clear goals, setting action plans, and providing accountability and motivation to help them reach their objectives. Coaching sessions focus on the client’s growth and development.

- Empowerment and Guidance: Coaches empower clients to find their own solutions by asking powerful questions, listening actively, and guiding them to unlock their potential, improve performance, or overcome obstacles.

- Various Types of Coaching: Coaching can cover diverse areas such as executive coaching, career coaching, life coaching, leadership coaching, wellness coaching, and more, each tailored to specific client needs.

Both consulting and coaching services involve building relationships based on trust, confidentiality, and expertise. Consultants and coaches often work independently or within consulting firms or coaching practices, providing services either on a one-on-one basis or to organizations seeking external guidance and support. The primary focus is on helping clients achieve their objectives, whether it’s business improvement, personal growth, or professional development.

Utilizing the Sharing Economy

The sharing economy refers to a socio-economic system where individuals or organizations share resources, assets, services, or skills with one another for mutual benefit. It leverages technology and platforms to facilitate transactions, often providing access to underutilized resources and creating opportunities for cost-effective sharing. Here are key aspects:

- Shared Assets: Utilizing assets or resources that are not fully utilized, such as cars, accommodations, tools, or expertise, by allowing others to use them for a fee or exchange.

- Peer-to-Peer Transactions: Transactions occur directly between individuals or peers, facilitated by digital platforms or apps that connect providers with users seeking specific services or assets.

- Examples of Sharing Economy Platforms:

- Accommodation Sharing: Platforms like Airbnb, Vrbo, and HomeAway allow individuals to rent out their homes, apartments, or spare rooms to travelers.

- Transportation Services: Ride-hailing apps such as Uber, Lyft, and Grab enable individuals to share rides or offer transportation services using their vehicles.

- Goods and Services Sharing: Platforms like TaskRabbit, ShareGrid, and Neighbor allow people to offer or rent out various goods or services, from tools and equipment to specific skills or expertise.

- Collaborative Consumption: Encourages the use of resources more efficiently, reducing waste and environmental impact by maximizing the utilization of existing assets.

- Flexibility and Cost Savings: Sharing economy models offer flexibility to both providers and users, allowing them to earn extra income by renting out assets or providing services, while consumers benefit from access to affordable and convenient options.

- Challenges and Regulations: The sharing economy has faced challenges related to regulatory compliance, safety concerns, labor rights, and tax implications in various jurisdictions.

Utilizing the sharing economy involves embracing the idea of access over ownership, where people can leverage existing resources to meet their needs without the need for ownership. It promotes a more sustainable and efficient use of resources while fostering collaboration and community-based interactions. However, it also requires addressing regulatory issues, ensuring fair practices, and balancing the benefits for all involved parties—providers, users, and the platforms facilitating these transactions.

“Cash Flow Explosion: Start Earning Big Bucks TODAY – Absolutely FREE Training!”

I appreciate you reading my full article, 9 Ingenious Money-Making Ideas to Fast-Track Your Wealth

Pingback: 19 Internet Hacks Every Student Should Know - Xgen Hub